A residential real estate purchase agreement (or residential real estate purchase contract) commits a buyer to an offer to purchase real estate. This article examines the different details which may apply, including signing and closing the agreement, terminating the agreement, and different provisions an agreement may include.

A real estate purchase document may also be called:

The process for agreeing to a real estate purchase includes the following:

Real estate agents who are licensed to practice law or specialized real estate attorneys may prepare a purchase agreement. In some cases, the buyer and seller may prepare the agreement themselves, but this represents an extreme degree of legal risk for both parties.

If the sale of the property is by the owner, the buyer’s agent could prepare the paperwork as a transactional agent or “dual agent,” despite the potential for a conflict of interest.

While many states allow dual agency, the following states do not:

Many specifics of a purchase agreement are open, and allow both the seller and buyer to negotiate terms which work for both parties. These include:

The agent(s) will help both the seller and buyer agree to the terms of the sale, allowing the purchase of the residential property.

A purchase agreement is a legally binding document signed by the seller and buyer. Each state has its own requirements when it comes to signing a real estate purchase agreement.

No state currently requires that a purchase agreement be notarized or signed by a witness. However, other real estate documents such as deeds, mortgages or any affidavits may require notary or witnessing.

If an agreement to purchase real estate is not executed by both the seller and buyer, it will not be enforceable.

Terminating a real estate purchase agreement varies from state to state. A purchase agreement is a legally binding document, so it may be difficult for a seller or buyer to terminate it without penalty, especially if there is no termination clause.

The purchase agreement is made to outline all conditions and contingencies which the seller and buyer may use to terminate the agreement. If either party decides to terminate for a reason that is not listed as a condition or contingency on the agreement, they can face consequences such as forfeiting the earnest money deposit, other financial penalties, or even a lawsuit.

A seller may legally back out of the purchase agreement in the following cases:

If a seller improperly terminates the purchase agreement, they may face legal consequences from both the buyer and their listing agent, including a lawsuit for breach of contract. The listing agent might even sue for marketing expenses, survey fees, legal fees or their commission.

A buyer may legally back out of a purchase agreement in the following cases:

If a buyer improperly terminates the purchase agreement, they may face legal consequences from both the seller and their listing agent. The purchase agreement might specify the consequences. Otherwise, the seller might sue for breach of contract.

Contingencies and conditions in the purchase agreement can decrease the financial and legal risks and repercussions of terminating a purchase agreement, for both the seller and buyer.

Real estate purchase agreements are as individual as the properties they cover. Each purchase agreement reflects the specific requirements of the sale. However, real estate contracts also have many elements in common, such as:

The purchase agreement should include the offered price accepted by the seller, as well as the payment method. Common methods include:

This information may be detailed in the purchase agreement, or the parties may include a financing addendum to specify the buyer’s down payment and lending situation.

A contingency clause outlines conditions or actions that a real estate purchase agreement depends on. If contingencies are not met, the purchase agreement may be canceled or modified, depending on the terms.

Common examples of a contingency clause include:

Each contingency has a specific deadline. If the deadline isn’t met, the agreement can be cancelled. If all contingencies are met, the contract becomes legally binding, and a party which backs out may face financial or legal penalties due to breach of contract.

Earnest money deposits (EMD) are a deposit which the buyer pays to show a good faith intent to purchase the seller’s property. Generally, the EMD is between 1-3% of the sale price, but depends on a variety of factors (e.g., the current market, the seller’s requirements, any limitation the state imposes, etc.). The EMD usually is due within 3 days after the execution of the purchase agreement.

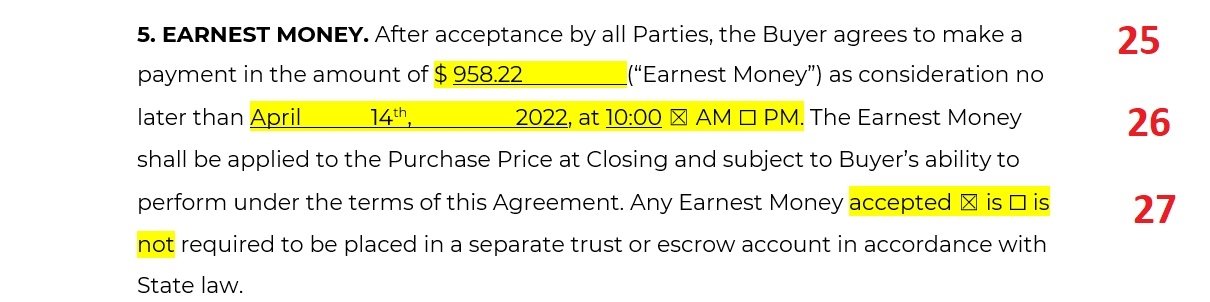

EMDs usually get paid via cashier’s check or wire transfer. They may be paid in installments or all at once. Once the seller receives the EMD funds, the seller’s agent should provide the buyer with an EMD receipt. In most cases, an EMD is refundable, but may have a cancellation fee depending on the specific agreement between buyer and seller.

The purchase agreement should include the date of the sale’s closing as well as a stipulation that any changes to the closing must be agreed in writing. Possession of the property typically transfers to the buyer at the listed closing date and time. The closing date also marks the transfer of the property’s title from the seller to the buyer. This may eventually be recorded in a bill of sale.

After signing the purchase agreement, the property is “under contract.” While under contract, the seller and buyer must complete the following tasks:

After the mortgage and other supporting documents are signed and the title company receives the mortgage company’s payment, the property is considered transferred to the buyer.

Each state has their own disclosure requirements. For instance, New York, there is a Property Condition Disclosure Act which requires a detailed disclosure statement with most property sales. These are some common types of real estate addendum and disclosure:

“Caveat emptor” is a Latin phrase which means “may the buyer beware.” In real estate transaction, this is when a seller is allowed to sell a property “as is.” Under a caveat emptor rule, the buyer has full responsibility to investigate and resolve any issues with the property.

The buyer asks the seller about defects on the property. The seller discloses that there was a leak in the roof, but a contractor made a repair. The buyer assumes that the roof is fixed and decides not to pursue a roof inspection before purchase. Under caveat emptor, the buyer cannot revoke the purchase or sue the seller if the roof still has issues.

The following states allow caveat emptor sales:

In states where caveat emptor applies, a buyer cannot cancel a purchase agreement or sue for damages for relying on a seller’s representations. The seller still must be honest in answering the buyer’s questions. Caveat emptor does not allow a seller to fraudulently conceal issues with a property.

To get started, download the Real Estate Purchase Agreement Template at the top of the page. This file can be viewed/opened as a PDF or as a Word document. This is a step-by-step explanation on how to fill out the agreement.

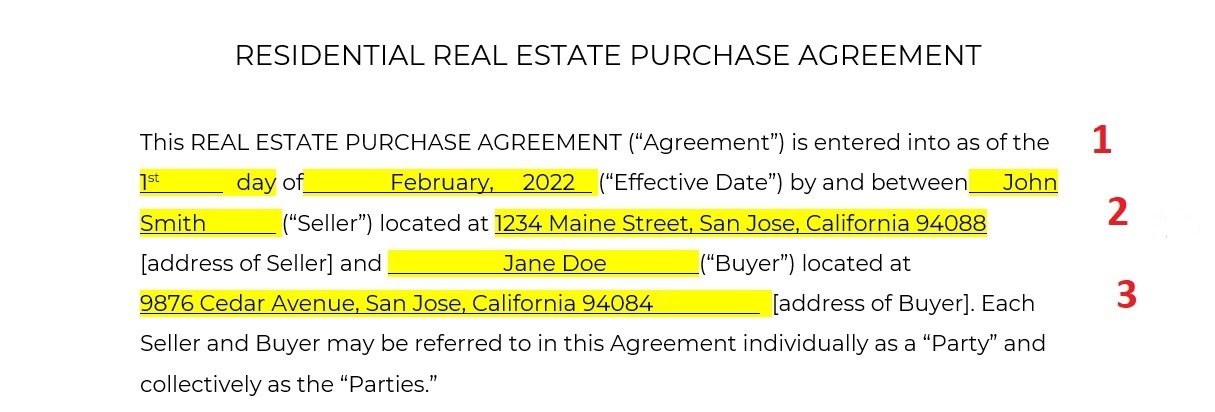

I. THE PARTIES, THE AGREEMENT AND THE PROPERTY

1. Indicate the date of the purchase agreement. The agreement will legally have effect as of the specified date.

2. Provide the Seller’s full name and address.

3. Provide the Buyer’s full name and address.

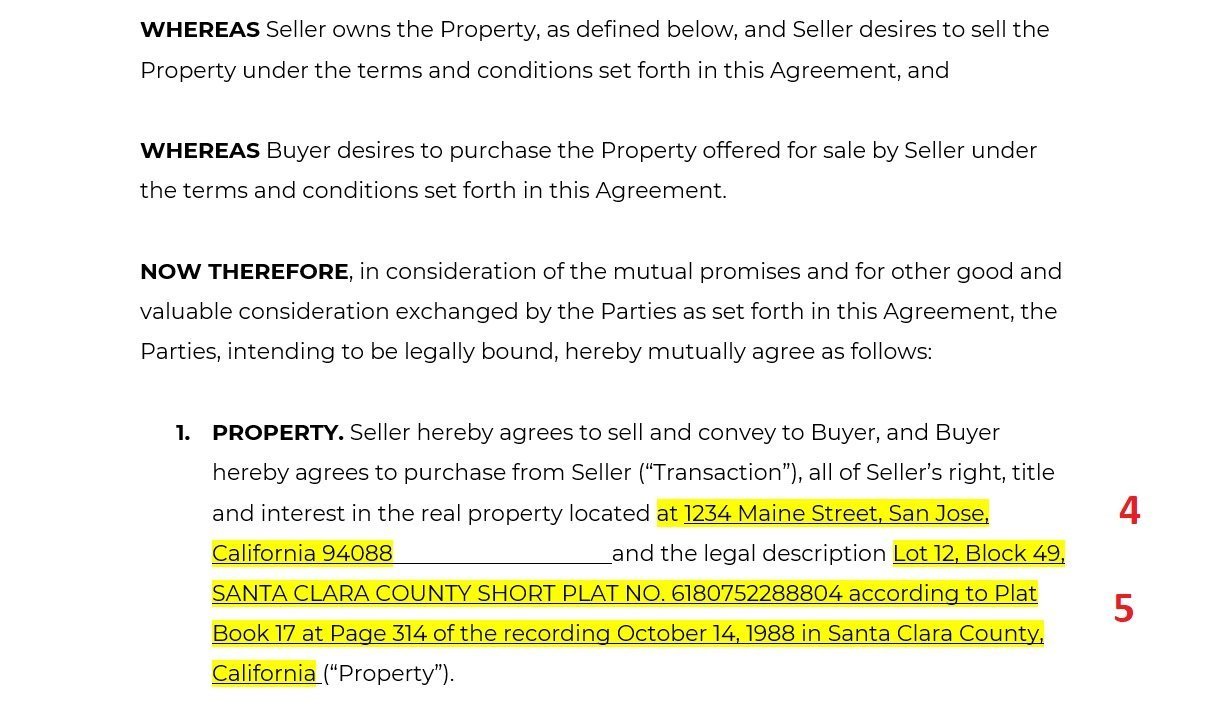

II. PROPERTY DESCRIPTION

4. Indicate the exact address of the residential property being sold to the Buyer.

5. Provide the legal description of the residential property that is being sold. (The local county records office can provide this information upon request.)

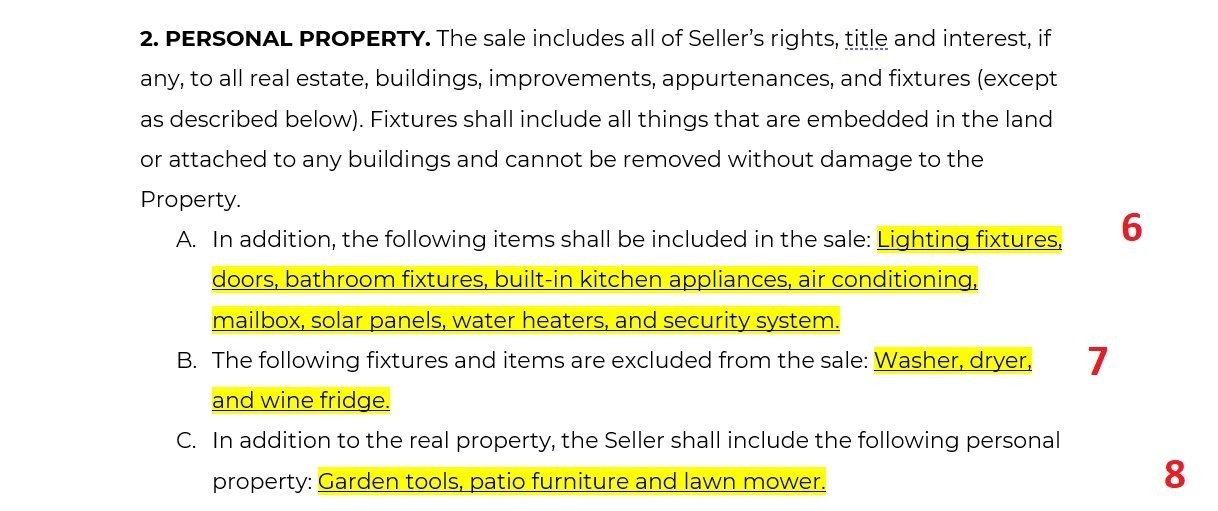

III. PERSONAL PROPERTY

6. Describe all items that to be included in the sale, including all fixtures which are embedded in the land or attached to the property and cannot be removed without damage.

7. Describe any fixtures and items excluded from the sale which will be taken by the Seller.

8. If there are items of personal property items the Seller is leaving behind (not embedded to the land), list them in the blank space provided.

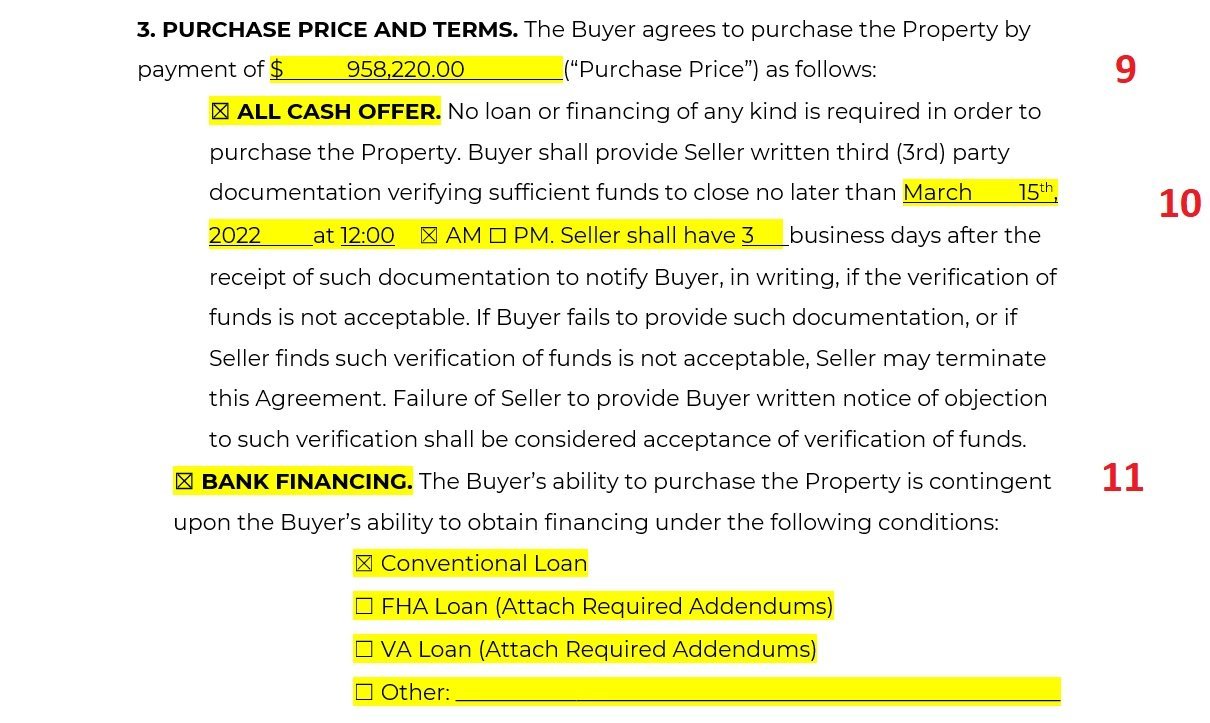

IV. PURCHASE PRICE AND TERMS

9. Indicate the dollar amount of the purchase price the Buyer agrees to pay for the property.

10. If the Buyer is paying for the property via an “All Cash Offer,” check this box. The date and time by which the Buyer should provide the Seller’s documentation to verify sufficient funds is written here. Also indicate the number of business days the Seller has to provide notice to the Buyer if the documentation of funds is not acceptable.

11. If the Buyer is purchasing the property through “Bank Financing,” check this box. Indicate, by checking the appropriate box, whether financing will be through a “Conventional Loan,” “FHA Loan,” “VA Loan,” or through “Other” financing (in which case, describe in the blank space provided).

V. ADDITIONAL TERMS

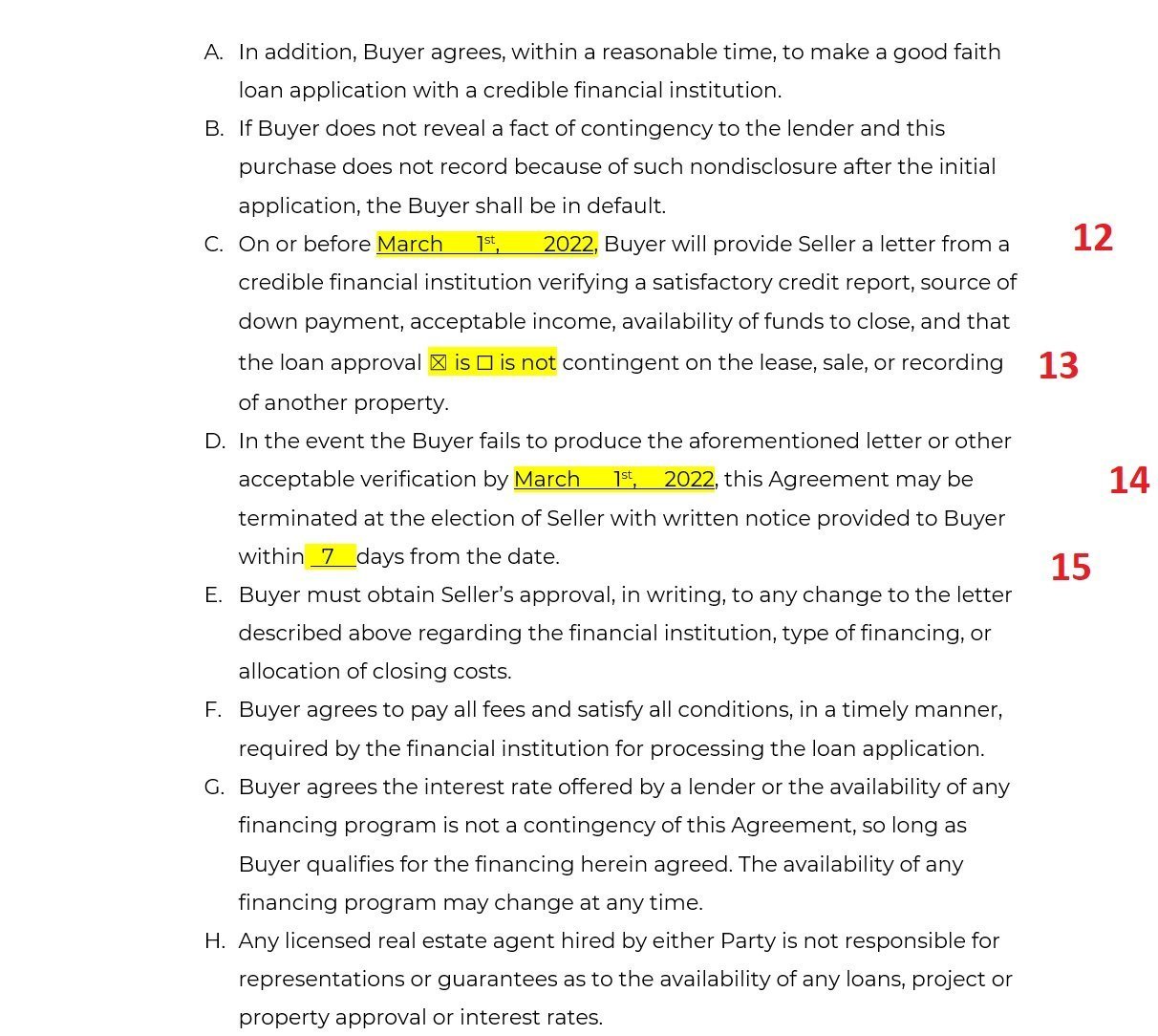

12. Indicate the date by which the Buyer will provide the Seller a letter from a credible financial institution to verify the Buyer’s credit report, source of down payment, acceptable income, and availability of funds to close the purchase of the property.

13. Identify whether the loan “is” or “is not” contingent on the lease, sale, or recording of another property.

14. Indicate the due date by which the Buyer must produce the letter from a credible financial institution.

15. In case the letter is not provided by the Buyer, indicate the amount of days the Seller has to provide written notice to terminate the purchase agreement.

VI. SELLER FINANCING

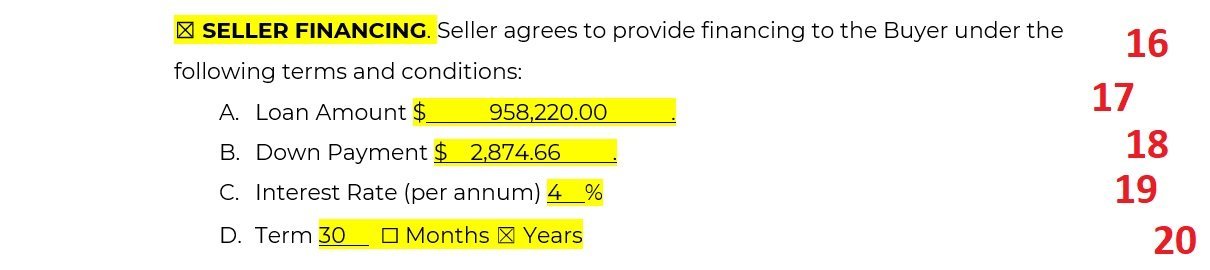

16. If the seller is providing financing to the Buyer for the purchase of the property, check the box marked “Seller Financing”.

17. Indicate the loan amount in dollars.

18. Indicate the down payment amount in dollars.

19. Indicate the yearly (per anuum) interest rate.

20. Indicate the loan term and check the box to mark whether the term is for “months” or “years.”

VII. SELLER FINANCING (Cont.)

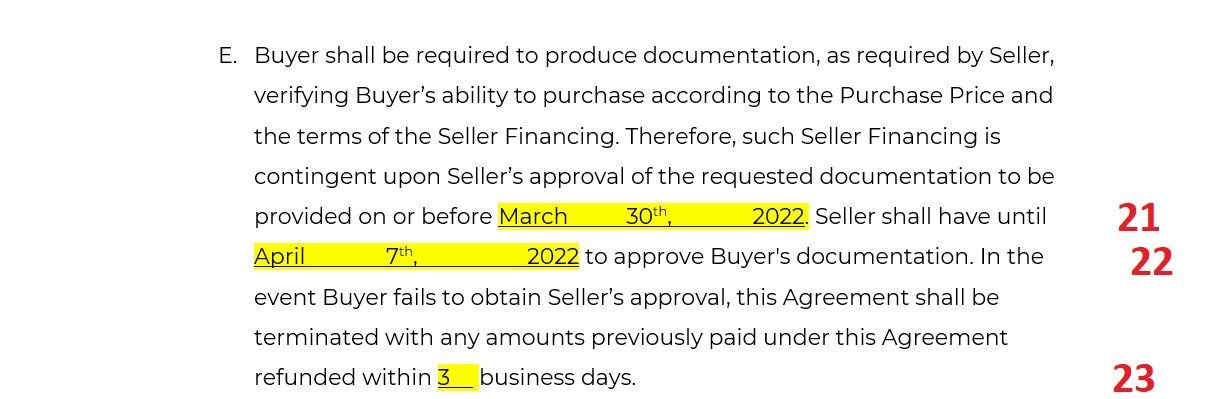

21. Indicate the date by which requested financing documentation is due.

22. Indicate the date by which the Seller must make a decision whether to approve the Buyer’s documentation.

23. If the Seller does not approve the purchase based on the documentation the Buyer provides, the purchase agreement terminates. Indicate the number of business days given for making a refund, in such case.

VIII. SALE OF ANOTHER PROPERTY

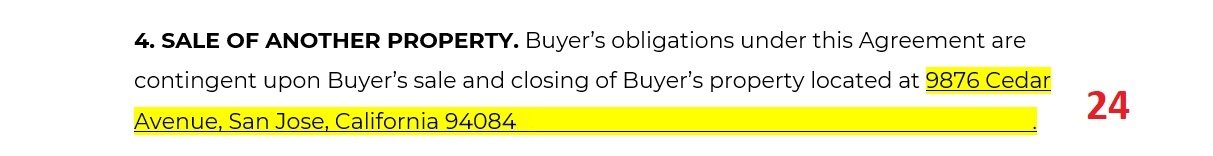

24. If the Buyer’s purchase depends on a property of the Buyer being sold and closed, provide the address.

IX. EARNEST MONEY

25. Write the dollar amount of the earnest money deposit that the Buyer agrees to pay.

26. Indicate the due date and time for the earnest money deposit. Check the “AM” or “PM” box to indicate time of day, as applicable.

27. Check the appropriate box to indicate whether the earnest money deposit “is” or “is not” required by state law to be placed in a separate trust or escrow account.

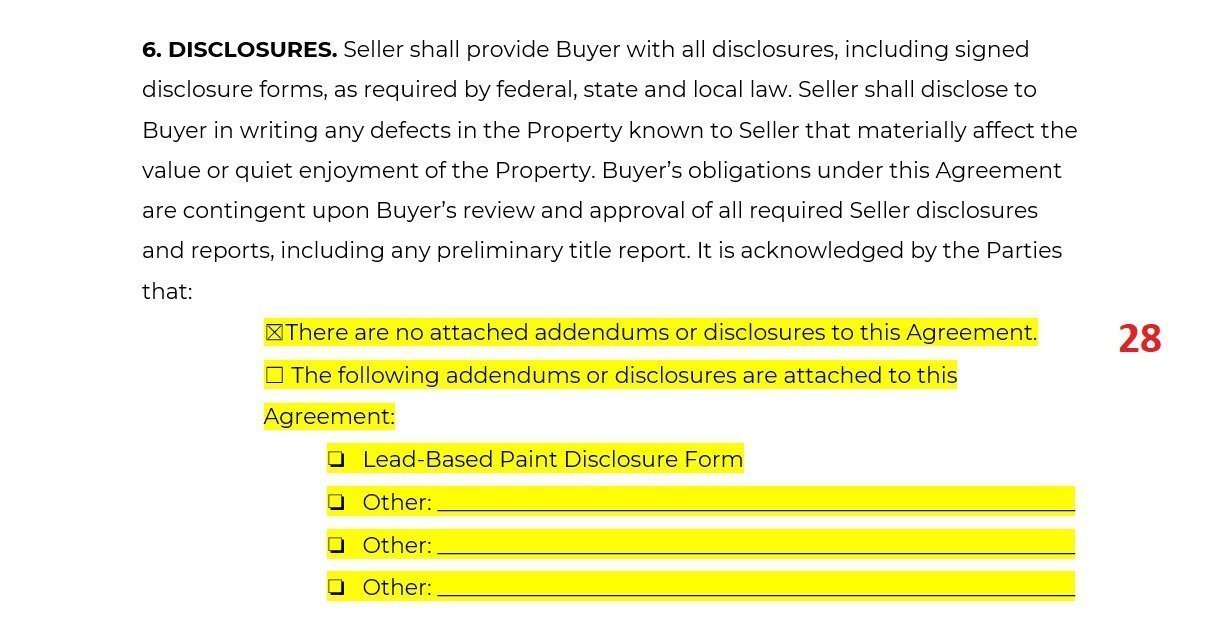

X. DISCLOSURES

28. Check the box to indicate whether there are attached addendums or disclosures to the purchase agreement (which may be either agreed between the parties, or else required by state or federal law). If there are addendums or disclosures, list them in the blank spaces provided.

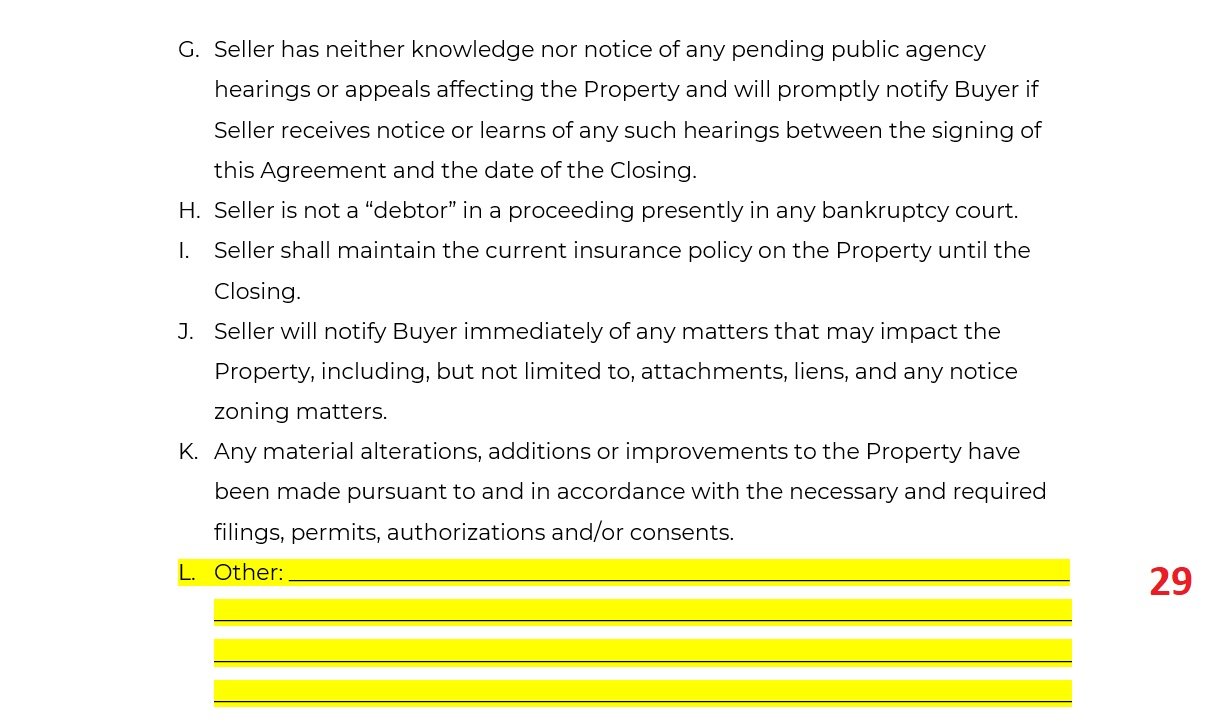

XI. SELLER REPRESENTATIONS AND WARRANTIES

29. If the Seller would like to add any warranties or guarantees about his own knowledge or the state of the property, it should be detailed in the blank space provided.

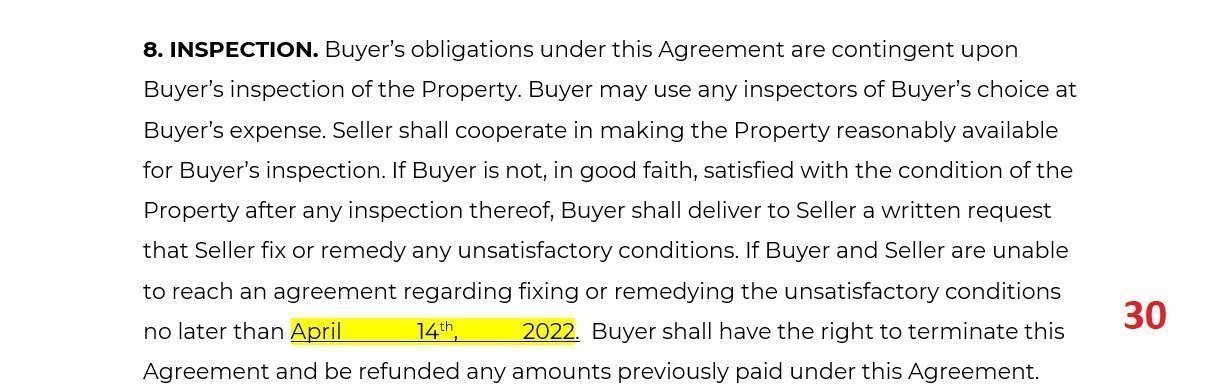

XII. INSPECTION

30. The Buyer’s obligation to purchase the property is contingent on the Buyer’s good faith inspection of the property. The Buyer or Seller must agree on an end date for agreeing to fix any issues that come up on inspection. If the agreement can’t be made by the indicated date, the Buyer has the right to terminate the purchase agreement and receive a refund of previous deposits.

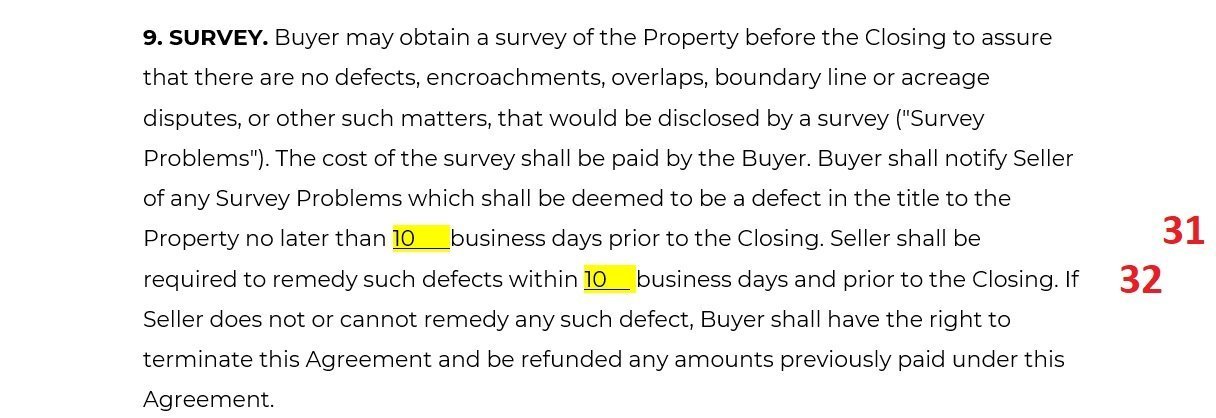

XIII. SURVEY

31. The Buyer has a right to obtain a survey of the property before closing to check for issues in the property lines, like overlaps, boundary disputes, etc. If a survey reveals problems, the Buyer must notify the Seller within a certain amount of time. Indicate how many business days the Buyer has to notify the Seller before closing.

32. Indicate how many days the Seller has to remedy any survey problems before closing.

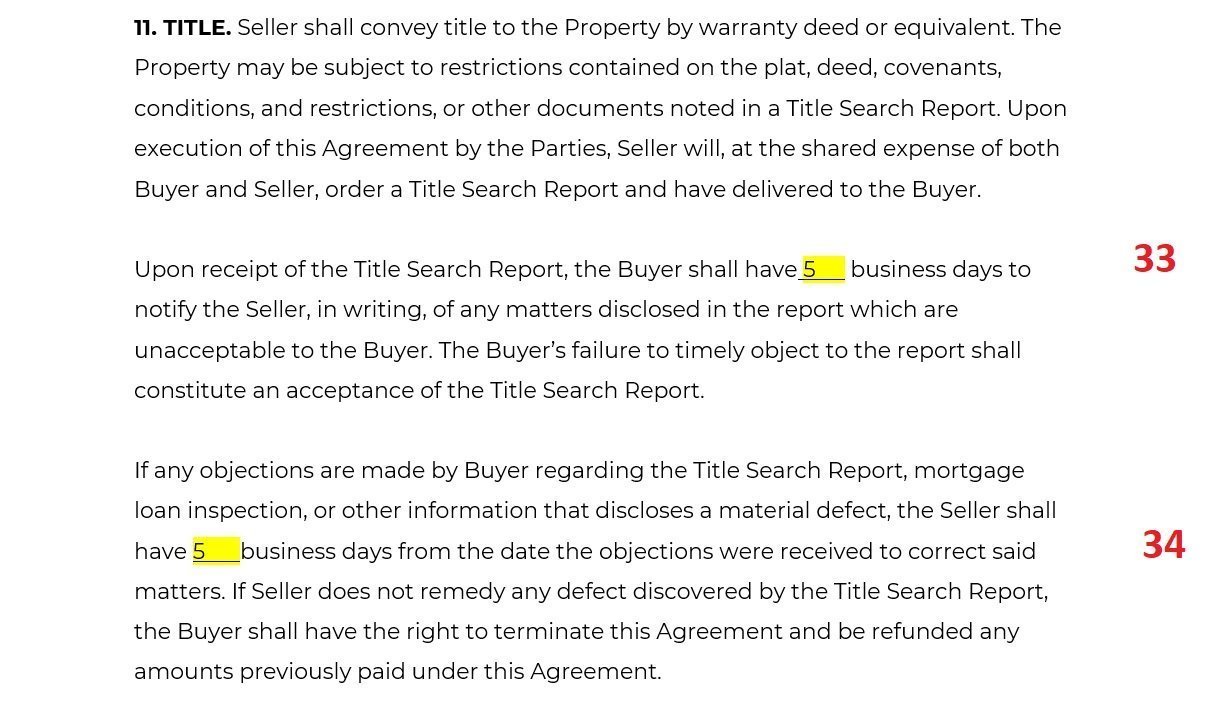

XIV. TITLE

33. Indicate how many business days the Buyer has to notify the Seller of any unacceptable issues found by the title search report.

34. Indicate how many business days the Seller has to remedy any defects found by the title search report, after an objection by the Buyer.

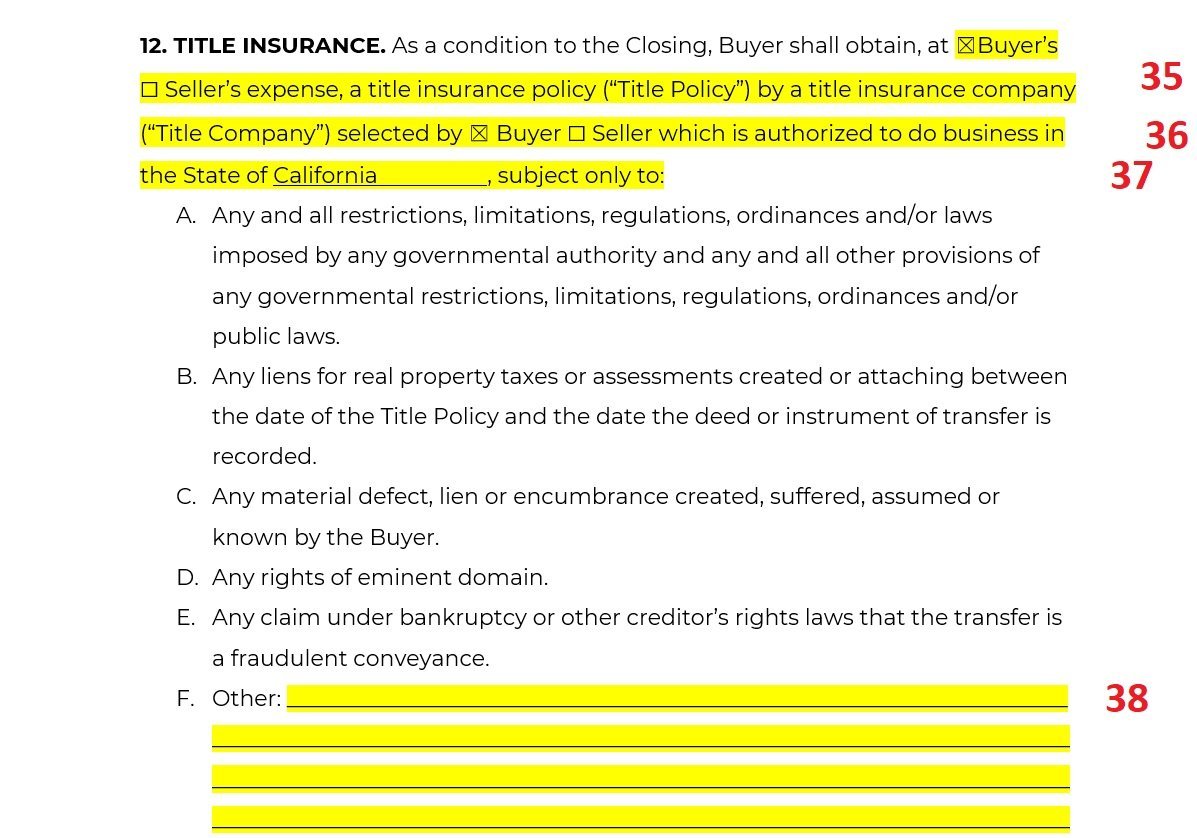

XV. TITLE INSURANCE

35. Check the box marked “Buyer’s” expense or check the box marked “Seller’s” expense to indicate which party is responsible for purchasing a title insurance policy.

36. Check “Buyer” or “Seller” to indicate who gets to select the title insurance company.

37. Indicate which state the title insurance company must be authorized to do business in.

38. Use the blank lines, if applicable, to fill in additional exceptions which should apply to the title insurance policy.

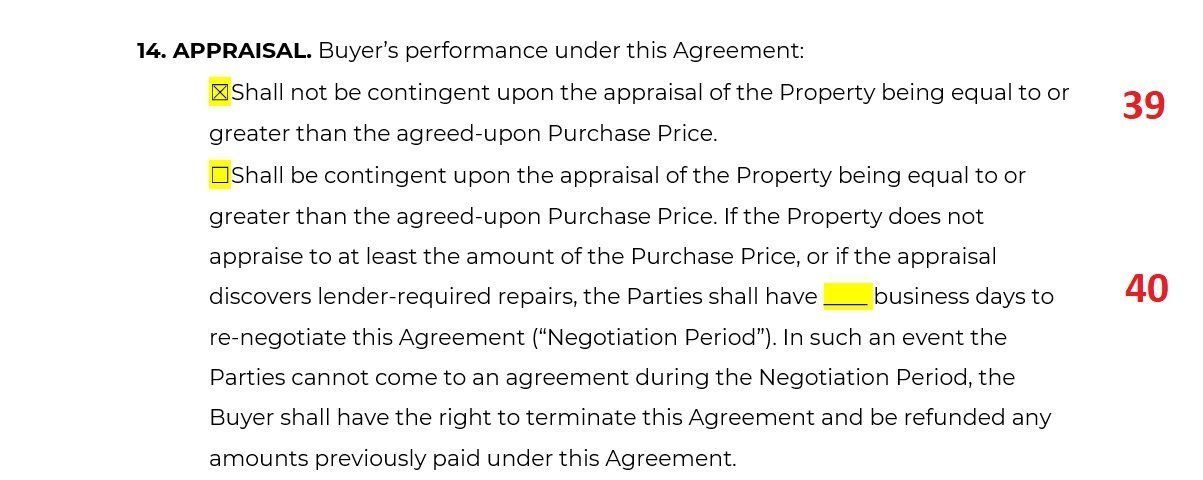

XVI. APPRAISAL

39. Check this box if the Buyer must complete the purchase even if the property is appraised at a lower value than the agreed-upon purchase price.

40. Check this box if the Buyer is allowed to renegotiate the purchase price after an appraisal that the property has a lower value than the agreed-upon purchase price. Also indicate how many business days the Parties have to renegotiate the purchase agreement if this happens.

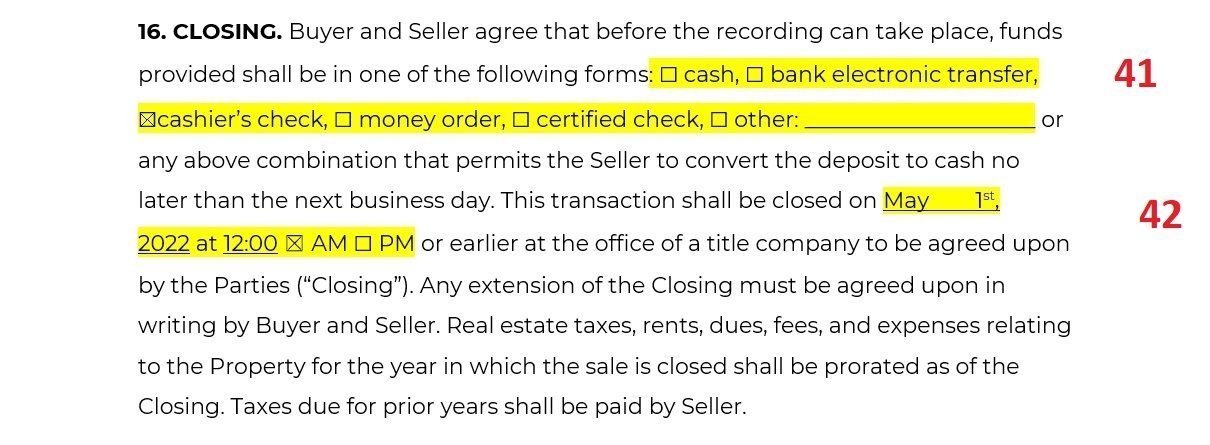

XVII. CLOSING

41. Indicate the method for providing funds to the Seller. Check either “cash,” “bank electronic transfer,” “cashier’s check,” “money order,” “certified check,” or “other.” If “other,” indicate the specific method(s) of payment in the blank space.

42. Include the date and time for closing the transaction. Check “AM” or “PM” box to specify the time of day.

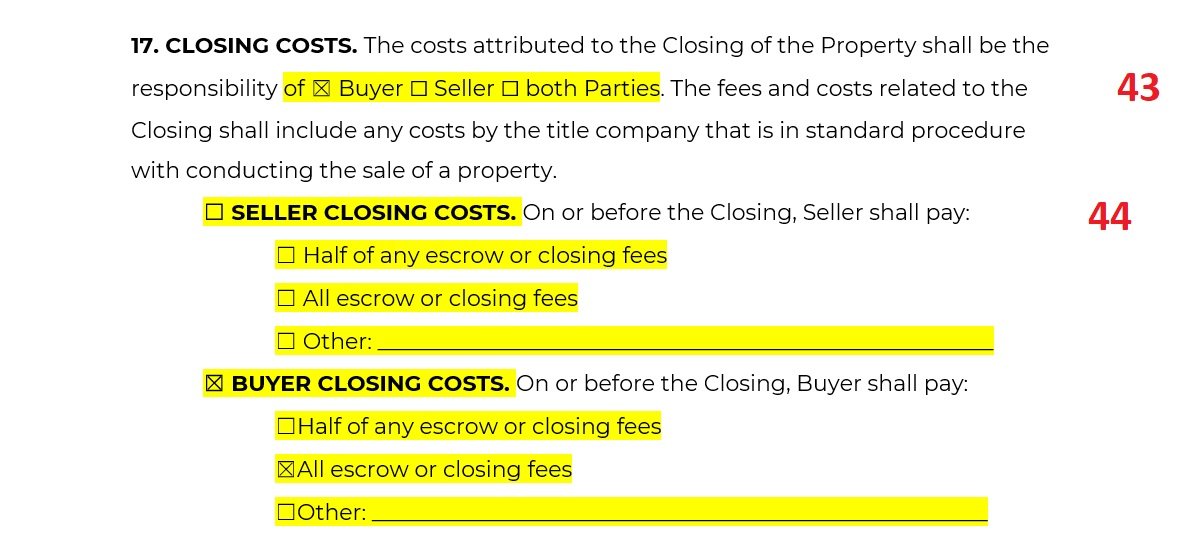

XVIII. CLOSING COSTS

43. Check “Buyer,” “Seller,” or “Both Parties” to indicate who will pay for the closing costs.

44. Check “Seller Closing Costs” or “Buyer Closing Costs” and indicate whether the party should pay “Half of Any Escrow or Closing Fees,” “All Escrow or Closing Fees” or “Other.” ( Note that the options selected must add up to exactly 100% of the closing costs. ) If “Other” is chosen, list how the different closing costs will be divided up.

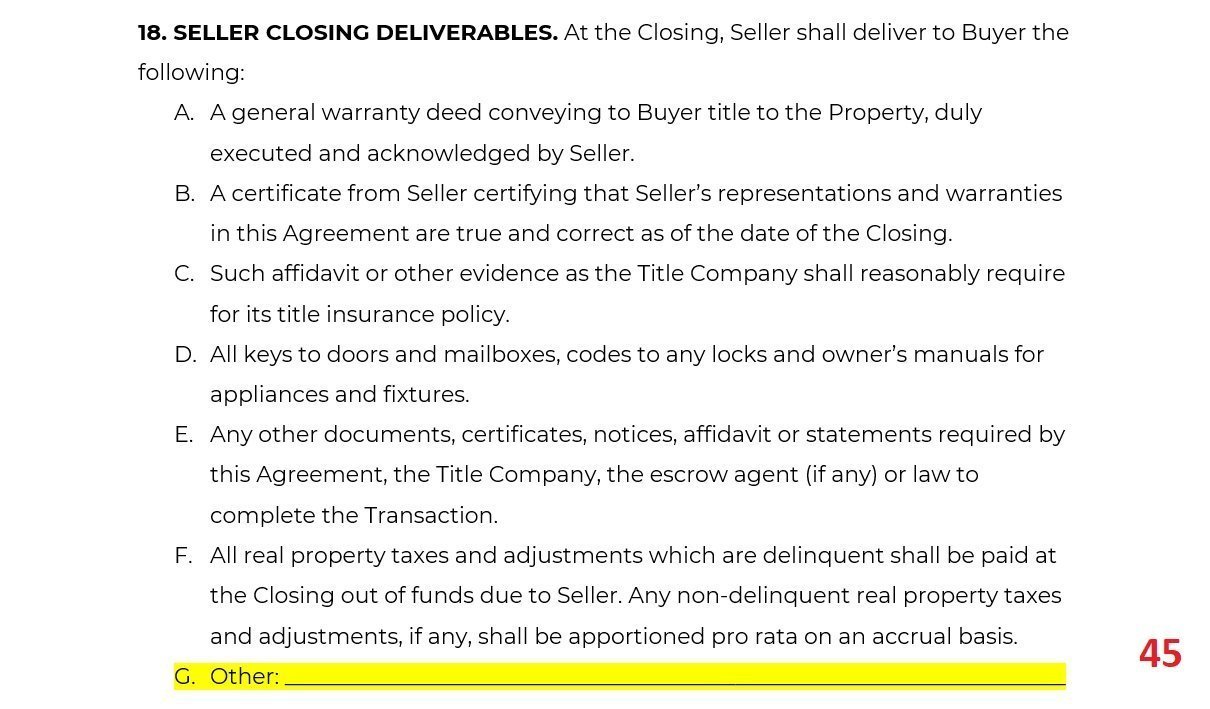

XIX. SELLER CLOSING DELIVERABLES

45. If applicable, use the blank to add in any extra items the Seller must deliver to the Buyer at closing.XX. BUYER CLOSING DELIVERABLES

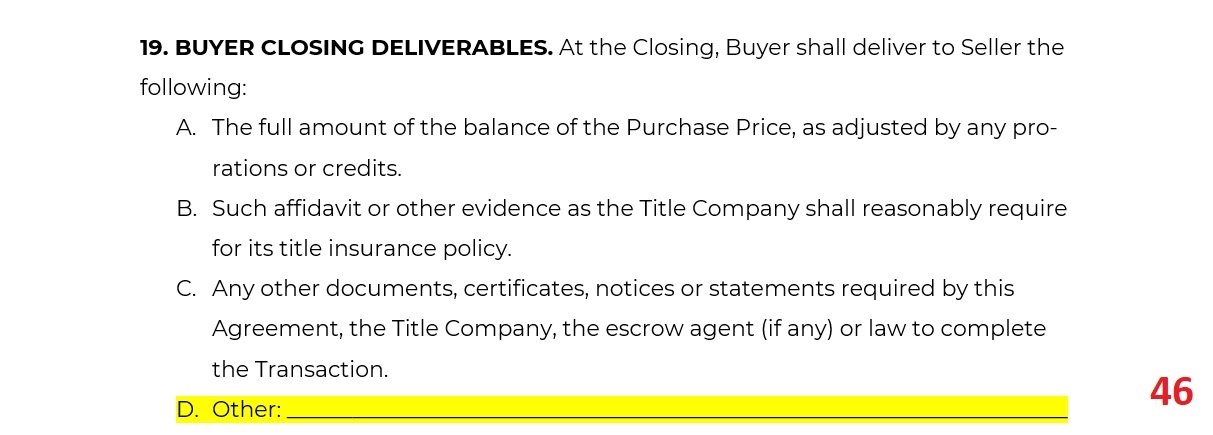

46. If applicable, use the blank to add in any extra items the Buyer must deliver to the Seller at closing.

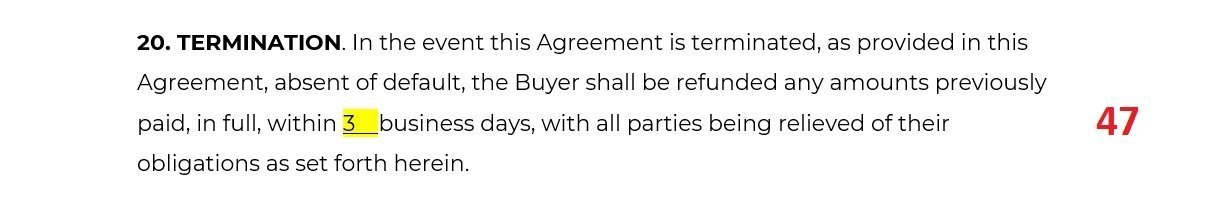

XXI. TERMINATION

47. If the agreement is terminated, payments made by the Buyer shall be refunded. Indicate how many business days the Seller has to make a full refund.

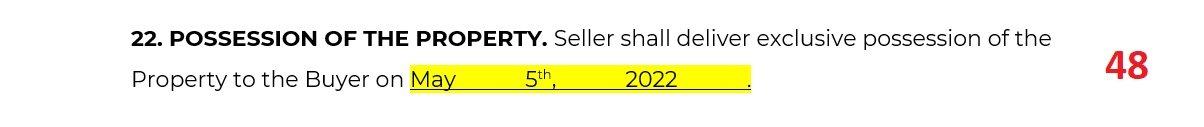

XXII. POSSESSION OF THE PROPERTY

48. Add the date by which the Seller must deliver the property to the Buyer.

XXIII. GOVERNING LAW

49. Specify the state laws which will govern the agreement. Excluding provisions for conflicts of law means only the laws of the specific state will be considered when interpreting the agreement.

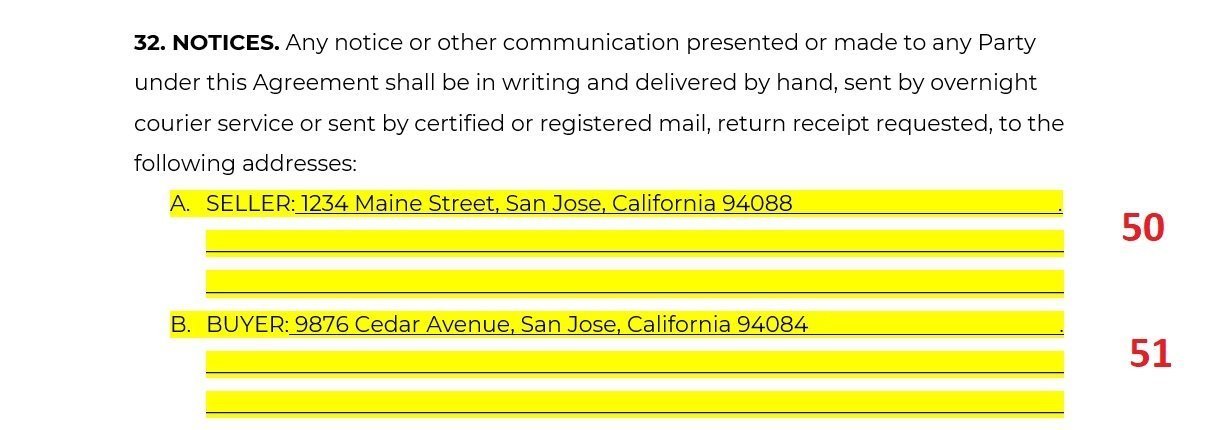

XXIV. NOTICES

50. Add the address of the Seller where notices or other communications may be delivered.

51. Add the address of the Buyer where notices or other communications may be delivered.

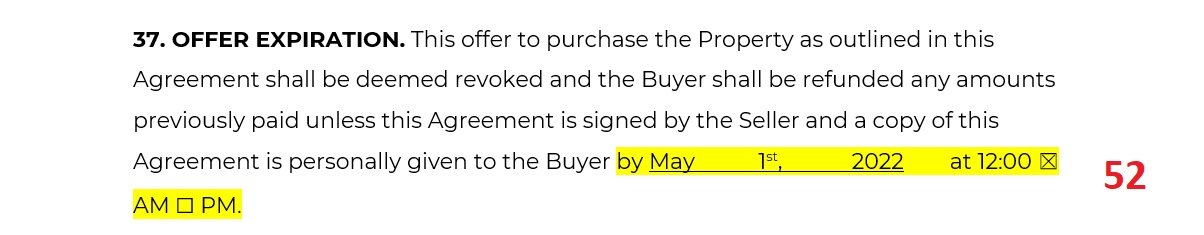

XXV. OFFER EXPIRATION

52. Indicate the date and time by which the Seller must sign the agreement and give a copy to the Buyer. If not done by the specified date, the agreement will be revoked. Check the”AM” or “PM” box to clarify the exact time agreed.

XXVI. ADDITIONAL TERMS AND CONDITIONS

53. Add any additional terms and conditions in the blank lines, as applicable.

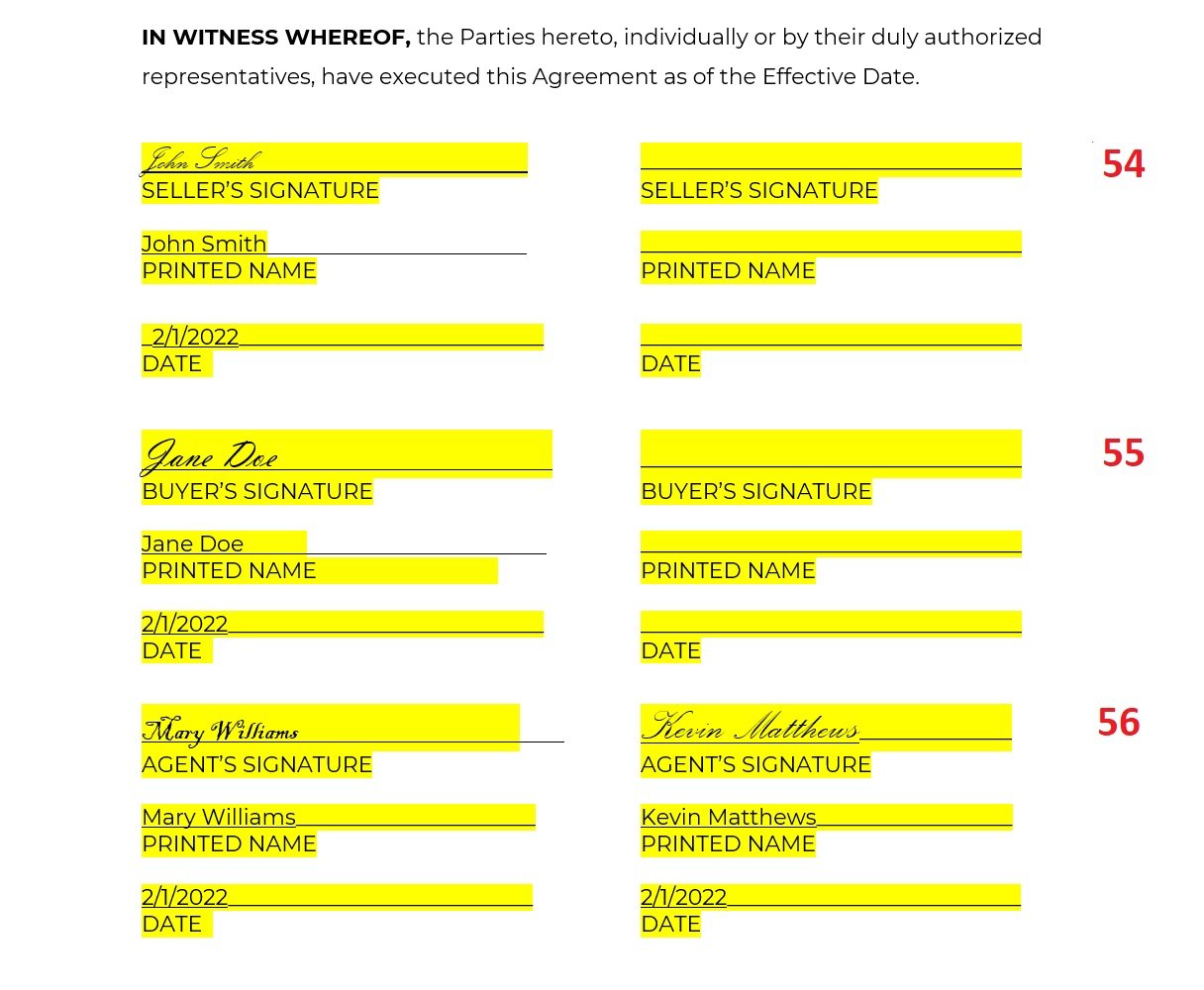

XXVII. SIGNATURES

54. Add the Seller’s signature, printed name, and date of execution.

55. Add the Buyer’s signature, printed name, and date of execution.

56. Add the Agents’ signatures, printed names, and dates of execution.

What Is a Warranty Deed? A Warranty Deed is a document filed with the County Recorder’s Office that grants title to real estate from the seller to the buyer. The document guarantees: The seller is entitled to sell the property There are no outstanding liens other than those listed on the Warranty Deed The buyer will be defended against any claims brought against the property by individuals claiming to have a prior interest in it Read more » What Is a Transfer Tax on Property? Most U.S. states collect a tax for every real estate transfer registered. Depending on your state, this tax may be referred to as a real estate transfer tax, deed tax or conveyance tax. Read more » What Is Title Insurance? Title insurance is a form of insurance required by most banks or lending institutions in order to get a mortgage—the lender will pay the insured party for any loss suffered in the event that there is a defect in the title that voids the buyer’s title to the property. Read more » What Is an Escrow Agent? An escrow agent is an independent third party who holds the property in a trust until the terms of the home purchase contract are met. Agents are responsible for collecting payments from the buyer and giving them to the seller. Both the seller and the buyer can give instructions to the escrow agent. Read more » What Is the Effective Date? The effective date is the date the parties become bound to the terms of the real estate contract—typically the day both parties sign the contract, or if the parties are signing on different days, the date the last party signs the contract. Read more » How Do You Find the Legal Description of a Property? A legal description of a property is how your land is defined on government records. The legal land description can be obtained from the County Recorder’s Office and may be found on a land title, in tax assessment information, or in a mortgage agreement. The legal description is not the same as a property’s street address, as this may change from time to time. However, it is still recommended to include the street address on a deed, for clarity. Read more » What Fixtures Are Typically Included in a House Sale? Fixtures are items that have been attached to land or property in such a way that they cannot be removed without damaging the item, the land, or the property. Examples of fixtures include built-in appliances and cabinets, light fittings and wall-to-wall carpeting. Read more »