Cash receipts are one of your governments most at-risk assets. SAO’s guides, best practices and checklists can help you improve your internal controls in key areas like segregation of duties, bank reconciliations, automated clearing house payments and wire transfers, and contracting with third-party receipting vendors.

Segregation of duties, or separating conflicting duty assignments, can help you protect your government’s assets. This guide can help local governments understand how to separate job duties when it’s feasible. It covers all types of financial processes from cash receipting to payroll and banking. The guide also includes additional control options for small governments or small operations within larger governments.

Keywords: Accounts Payable, Accounts Receivable, AP, AR, Assets, Cash Receipting, Receipt, Receipts, Internal Controls, Payroll

Last updated: September 2019

For governments looking to accept or process payments, these best practices can help ensure you have controls in place to protect your revenue streams and comply with any requirements.

Keywords: Cash Receipting, Receipt, Receipts, Internal Controls

Last updated: September 2020

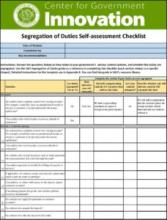

This customizable checklist can help governments analyze their own internal controls and identify risky areas in need of possible improvement. This is one of many helpful checklists our Office offers.

Keywords: Accounts Payable, Accounts Receivable, AP, AR, Assets, Cash Receipting, Receipt, Receipts, Internal Controls, Payroll

Last updated: September 2019

This guide offers tips and best practices for managing your cash collections. It includes a suite of short, one-to-two-page resources for leaders, managers, supervisors and payroll clerks. It can be printed in sections and distributed to whomever is in charge of certain responsibilities.

Keywords: Cash Receipting, Receipt, Receipts, Internal Controls

Last updated: June 2020

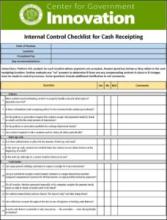

This customizable checklist can help governments analyze their internal controls for cash receipting functions to identify weaknesses in need of new or improved controls This is one of many helpful checklists our Office offers.

Keywords: Cash Receipting, Receipt, Receipts, Internal Controls

Last updated: September 2020

These best practices around the bank reconciliation process can help governments detect fraud and ensure their data and financial statements are accurate. It includes a template to document a global bank reconciliation for local governments.

Keywords: Bank Reconciliation, Cash Receipting, Receipt, Receipts, Internal Controls

Last updated: January 2020

This customizable, four-column bank reconciliation template, or proof of cash, reconciles ending cash, deposits and withdrawals to activity reported on the financial statements. It shows how a government may document reconciliations of all its bank accounts, ultimately agreeing the records to the financial statements.

Keywords: Bank Reconciliation, Cash Receipting, Receipt, Receipts, Internal Controls

Last updated: January 2020